Introduction

If you’re just starting your financial journey, one of the most important steps you can take is learning how to invest money wisely. Many beginners delay investing because it feels complex or risky, but the truth is: the earlier you start investing, the easier wealth building becomes.

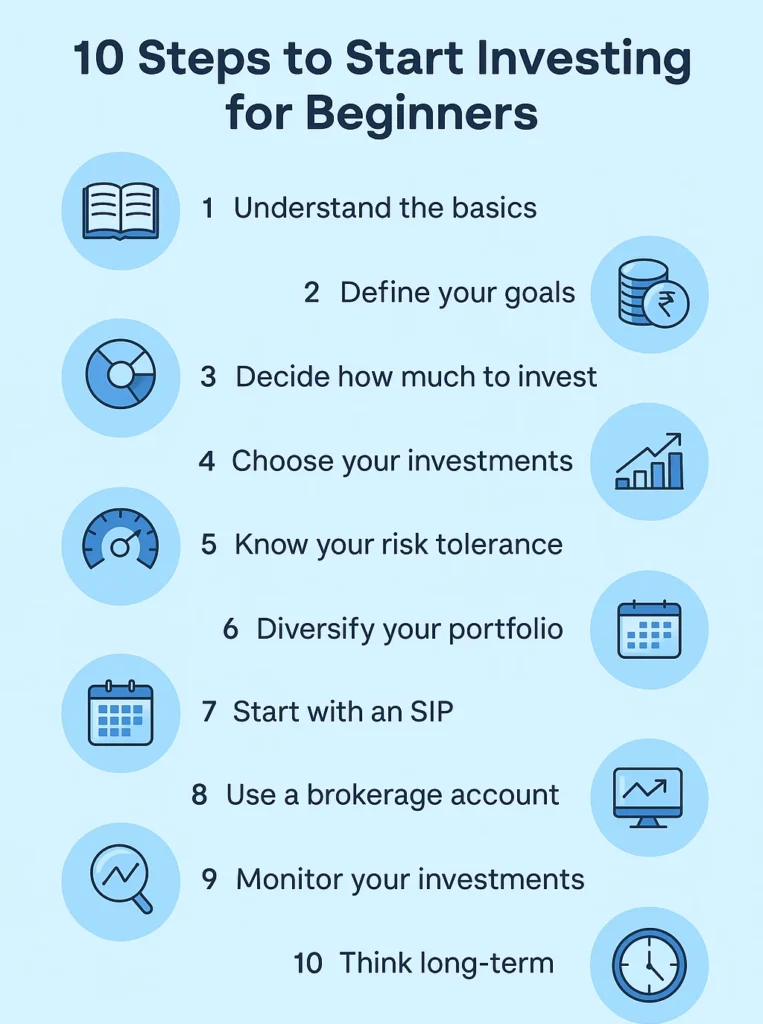

This Ultimate Guide to Investing for Beginners breaks down everything you need to know — from the basics of stocks, mutual funds, and ETFs to risk management, diversification, and long-term strategies. Whether you’re looking for “how to start investing with little money” or want a “step-by-step investing guide for beginners”, this article will help you get started.

Why Should Beginners Invest?

Many beginners wonder: “Why not just save money in the bank?” The answer is inflation. Prices rise every year, and your savings lose value if they don’t grow faster than inflation.

Benefits of Investing

- Wealth Growth – Investments grow faster than savings accounts.

- Financial Freedom – Smart investing helps you retire early.

- Beating Inflation – Investments ensure your money maintains value.

- Passive Income – Dividends, interest, and rental income provide cash flow.

👉 If you’re wondering about “reasons to invest your money”, the biggest one is simple: to make your money work for you.

Step 1 – Understand the Basics of Investing

Before diving in, you need to learn some investment basics for beginners.

Key Investment Terms

- Principal – The money you invest.

- Return on Investment (ROI) – Profit or loss compared to investment amount.

- Risk – Possibility of losing money.

- Diversification – Spreading investments to reduce risk.

- Compounding – Growth on both your principal and past returns.

👉 One of the most powerful investing tips for beginners is: start small and let compounding do the magic over time.

Step 2 – Types of Investments for Beginners

Not all investments are the same. Here are the most common types:

Stocks (Equities)

- You buy a share of ownership in a company.

- High risk, high return.

- Great for long-term wealth building.

Mutual Funds

- Pool of money managed by professionals.

- Safer than individual stocks for beginners.

- Start with SIPs (Systematic Investment Plans) for steady investing.

Exchange-Traded Funds (ETFs)

- Like mutual funds but trade like stocks.

- Low fees, diversified, beginner-friendly.

Bonds

- You lend money to the government or companies.

- Lower risk, lower return.

- Ideal for conservative investors.

Real Estate

- Property investment for rental income or resale.

- Requires higher capital, but can generate steady income.

👉 Searching “best investments for beginners ”? Start with mutual funds, ETFs, and index funds.

Step 3 – How to Start Investing with Little Money

You don’t need thousands to begin investing. Even small amounts can grow significantly over time.

- Start SIPs with as little as ₹500/$10 per month.

- Use fractional investing platforms (buy part of a share).

- Choose low-cost ETFs and index funds.

👉 Many beginners look for “how to start investing with little money”. The answer: start small but start early.

Step 4 – Risk Management and Diversification

The golden rule of investing: Never put all your eggs in one basket.

Risk Management Tips

- Don’t invest money you can’t afford to lose.

- Diversify across stocks, bonds, funds, and real estate.

- Review and rebalance your portfolio yearly.

👉 If you’re worried about “investment risks for beginners”, remember: diversification is your safety net.

Step 5 – Long-Term vs Short-Term Investing

Short-Term Investing

- Goals within 1–3 years.

- Safer investments like bonds, FDs, or liquid funds.

Long-Term Investing

- Goals like retirement, home, or wealth creation.

- Best options: stocks, mutual funds, ETFs.

- Benefits from compounding.

👉 Most beginner investing strategies should focus on long-term investing.

Step 6 – Beginner-Friendly Investment Strategies

Cost Averaging

- Invest the same amount regularly (like SIPs).

- Reduces the risk of market timing.

Buy and Hold

- Hold investments for years, ignoring short-term ups and downs.

Index Fund Investing

- Invest in funds that mirror the stock market index.

- Low fees, diversified, beginner-approved.

👉 Searching “safe investing strategies for beginners”? Stick to index funds + SIPs.

Step 7 – Common Mistakes Beginners Should Avoid

❌ Trying to time the market

❌ Putting all money in one stock

❌ Investing without goals

❌ Ignoring emergency funds

❌ Panic selling when markets drop

👉 One of the most important beginner investing tips: Stay consistent and patient.

Step 8 – How to Create Your First Investment Plan

- Define your goals (retirement, house, passive income).

- Decide time horizon (short, medium, long-term).

- Assess your risk tolerance (low, medium, high).

- Choose asset mix (stocks, funds, bonds).

- Automate investments (SIPs, recurring deposits).

- Review annually and rebalance.

Step 9 – Tools and Apps for Beginner Investors

- India: Groww, Zerodha, Upstox.

- US/Global: Robinhood, Vanguard, Fidelity, Acorns.

- Tracking tools: Google Finance, Moneycontrol, Mint.

👉 Use apps for automatic investing for beginners to keep things simple.

Step 10 – Building Wealth Step by Step

Investing is not about getting rich overnight. It’s about building wealth slowly and smartly.

- Save consistently.

- Invest regularly.

- Reinvest profits.

- Avoid emotional decisions.

👉 This is the roadmap to financial freedom step by step.

FAQs on Investing for Beginners

Q1: How much money do I need to start investing?

You can start investing with as little as ₹500/$10 per month through SIPs or ETFs.

Q2: What’s the safest investment for beginners?

Index funds, mutual funds, and bonds are generally safe for beginners.

Q3: Should I save or invest first?

Build an emergency fund first, then start investing for long-term goals.

Q4: How do I start investing if I know nothing?

Begin with SIPs in mutual funds or index funds, use robo-advisors, and learn step by step.

Q5: Is investing risky for beginners?

All investing carries risk, but diversification and long-term planning reduce risks significantly.

Conclusion – Your Journey as a Beginner Investor

The ultimate guide to investing for beginners boils down to this: start small, start early, stay consistent.

By learning investment basics, using beginner-friendly strategies like SIPs and index funds, managing risk, and avoiding common mistakes, you’ll build wealth steadily and achieve financial freedom step by step.

👉 Remember: The best time to start investing was yesterday. The next best time is today.