The coworking giant WeWork India is making headlines with its upcoming IPO in October 2025. For many investors, the first question is simple: Should I invest in the WeWork IPO?

Globally, WeWork is a brand with a rollercoaster history — from sky-high valuations in the U.S. to bankruptcy. But in India, the story is different. Here, WeWork has grown into one of the biggest coworking space providers, with over 68 centers and nearly 114,077 desks across 8 cities. The cities where WeWork operates its centers are Bengaluru, Pune, Mumbai, Hyderabad, Gurugram, Chennai, Noida and Delhi.

Here we will be talking about WeWork India IPO details, business model, SWOT analysis, competitor comparison, and investment verdict so you can make an informed decision.

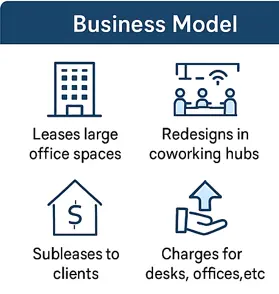

WeWork India’s Business Model: How Does It Make Money?

Think of WeWork as the “Uber of office spaces.” Instead of companies locking themselves into 5- or 10-year leases, they can rent flexible desks or private offices for a few months — or even days.

Here’s how WeWork India’s business model works:

- Leases large office spaces from landlords.

- Redesigns them into trendy, fully-equipped coworking hubs.

- Subleases to clients like startups, freelancers, and corporates.

- Charges for desks, private cabins, and enterprise offices.

💡 In short: WeWork’s money comes from turning rigid real estate into flexible, modern workplaces.

The catch? While clients pay on flexible terms, WeWork is stuck with long-term leases. This mismatch makes profitability tricky, especially if demand slows down, as was the case during Covid-19.

IPO Details: Dates, Price, and Issue Size

- IPO Open: October 3, 2025

- IPO Close: October 7, 2025

- Listing Date: October 10, 2025 (tentative)

- Price Band: ₹615 – ₹648 per share

- Issue Size: ~₹3,000 crore (≈ $360 million)

- Type: Offer for Sale (OFS) – existing shareholders(Embassy Buildcon LLP and 1 Ariel Way Tenant Ltd.) are selling; no fresh funds for the company.

📉 Financials: Operating revenue grew by 19.3% in the April-June 2025 Quarter (Q1 FY26) to ₹535.3 crore from ₹448.6 crore as compared to the same quarter in the previous year (Q1 FY25). WeWork also reported a loss of ₹14.1 crore for Q1 FY26 as compared to ₹29.17 crore in Q1 FY25, showing a marked improvement.

Also Read : IPO in India: A Complete Comprehensive Guide

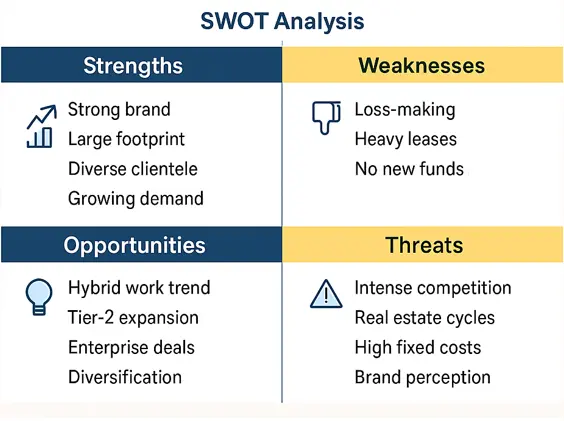

SWOT Analysis: WeWork India

Strengths

- Strong global brand with high recall.

- Large Indian footprint (68 centers, 8 cities).

- Diverse client base (from freelancers to Fortune 500 firms).

- Growing demand for flexible workspaces.

Weaknesses

- Still loss-making despite revenue growth.

- Lease-heavy model = high fixed costs.

- IPO is only an OFS → no new growth capital.

- Limited Tier-2 presence.

Opportunities

- Hybrid work trend → corporates want smaller, flexible offices.

- Untapped Tier-2 city market.

- Growing enterprise deals.

- Diversification into managed office services.

Threats

- Strong rivals like Awfis, Smartworks.

- Real estate cycles can hit occupancy.

- High fixed lease liabilities.

- Global brand perception issues (due to U.S. collapse).

WeWork India vs Competitors

The coworking battle in India is heating up. Here’s how WeWork India compares:

| Factor | WeWork India | Awfis | Smartworks | 91Springboard |

|---|---|---|---|---|

| Brand Recognition | Global, premium | Popular Indian brand | Corporate-first | Startup-focused |

| Scale | 68 centers, 8 cities | 200+ centers, 18 cities | 54 centers, 15 cities | 20+ centers |

| Model | Lease-heavy | Franchise + managed | Corporate-first | Community-driven |

| Target | Startups + corporates | SMEs, corporates | Large enterprises | Freelancers |

| IPO/Funding | OFS IPO 2025 | IPO plans in pipeline | Private | Private |

💡 Key Insight: WeWork India has brand power but faces tough competition. Awfis is scaling the fastest, Smartworks is cornering corporates, and several smaller players dominate niche startup communities.

Should You Invest in the WeWork India IPO?

This WeWork IPO is a double-edged sword.

✅ Positives:

- Big brand, established presence.

- Flexible office model matches India’s booming startup + hybrid work ecosystem.

- Growth in demand for coworking is real.

❌ Negatives:

- Still loss-making.

- Heavy lease liabilities.

- IPO is only an OFS → company won’t get new funds.

- Competition is intense.

Frequently Asked Questions (FAQ) About WeWork India IPO

Q1. What is the WeWork India IPO price band?

The WeWork India IPO price band is set between ₹615 and ₹648 per share.

Q2. When does the WeWork India IPO open and close?

The IPO opens on October 3, 2025 and closes on October 7, 2025.

Q3. When will WeWork India list on the stock exchange?

WeWork India shares are expected to list on October 10, 2025 (tentative date).

Q4. Is the WeWork India IPO a fresh issue or an Offer for Sale (OFS)?

It is an Offer for Sale (OFS), meaning existing shareholders are selling their shares. The company itself will not receive new funds from this IPO.

Q5. Is WeWork India profitable?

No, as of Q1 FY26, the company reported a loss of ₹14.1 crore, despite a ~19% increase in revenue.

Q6. Should I invest in the WeWork India IPO?

The IPO is a high-risk, speculative opportunity. Investors with high risk tolerance may consider a small allocation, but conservative investors should wait until the company shows consistent profitability.

Q7. Who are WeWork India’s main competitors?

WeWork India competes with Awfis, Smartworks, 91Springboard, and CoWrks, all of which are growing aggressively in India’s coworking space market.

Verdict:

If you’re a conservative investor looking for stability → Skip this IPO for now.

If you’re a risk-tolerant investor willing to bet on India’s coworking future → You can consider a small, speculative allocation.

Final Word

The WeWork India IPO is more of a brand + growth story than a profit-driven one right now. With hybrid work gaining momentum, the sector looks promising — but the business model has cracks, and profitability is not guaranteed.

👉 Bottom line: Don’t expect overnight returns. This is a high-risk, high-reward bet on India’s changing work culture. If you invest, do it cautiously and as part of a diversified portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice.