Introduction

Retirement is not just the end of your working years — it’s the beginning of a new chapter in life. But to enjoy that chapter without financial stress, you need to start planning early.

In India, where inflation rises steadily and medical costs are increasing, having a solid retirement plan is essential. Unfortunately, many people delay planning, thinking they’ll do it “later.” The truth is, the earlier you start retirement planning in India, the easier it becomes to build a secure future.

This step-by-step retirement planning guide will help you understand savings strategies, pension schemes, government options, and investment plans suitable for Indian investors.

Why Retirement Planning is Important in India

Unlike some Western countries, India doesn’t have widespread state-sponsored pensions. That means you are largely responsible for creating your own retirement corpus.

Key Reasons to Plan Retirement

- Rising Life Expectancy – You may live 25–30 years post-retirement.

- Inflation – ₹50 lakh today won’t have the same value in 20 years.

- Medical Costs – Healthcare expenses grow faster than inflation.

- Financial Independence – Avoid depending on children or relatives.

👉 If you’re wondering “why retirement planning is important in India”, the answer is simple: to secure your future without compromise.

Step 1 – Calculate Your Retirement Needs

The first step is knowing how much money you’ll need after retirement.

Factors to Consider:

- Current expenses (housing, food, healthcare).

- Expected inflation (average 6–7% in India).

- Number of years after retirement (life expectancy).

- Lifestyle goals (travel, hobbies).

👉 A common formula is:

Retirement Corpus = Annual Expenses × 25

So, if you need ₹6 lakh a year → ₹6 lakh × 25 = ₹1.5 crore corpus.

Step 2 – Start Saving Early

The earlier you start saving, the more you benefit from compounding.

Example of Compounding (SIP in Mutual Funds at 12% return):

- Start at 25 → ₹5,000/month = ₹3.5 crore by age 60.

- Start at 35 → ₹5,000/month = ₹1.2 crore by age 60.

👉 This is why experts emphasize retirement planning for young professionals — even small savings add up over time.

Step 3 – Build an Emergency Fund

Before locking money into long-term retirement plans, build an emergency fund worth 6–12 months of expenses.

- Keep it in liquid funds or savings accounts.

- Prevents dipping into retirement savings during crises.

Step 4 – Invest in Retirement Planning Schemes in India

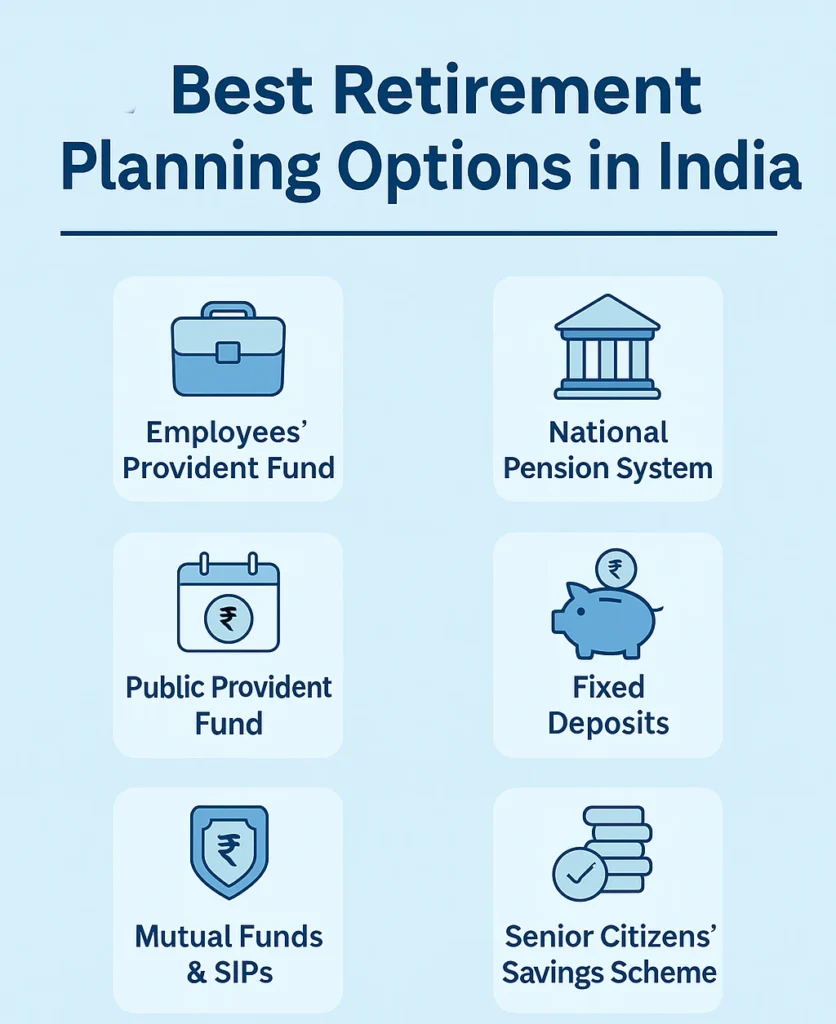

India offers multiple options for retirement planning. Here are the most popular:

1. Employees’ Provident Fund (EPF)

- Mandatory for salaried employees.

- Employer and employee contribute 12% each.

- Interest ~8% p.a. (tax-free).

2. Public Provident Fund (PPF)

- 15-year lock-in, extendable in 5-year blocks.

- Safe, backed by the government.

- Interest rate ~7–8%.

3. National Pension System (NPS)

- Flexible contributions.

- Invests in equity, debt, and government securities.

- Tax benefits under Section 80CCD(1B) (Old scheme).

4. Atal Pension Yojana (APY)

- Government-backed scheme for unorganized workers.

- Provides fixed monthly pension post-retirement.

5. Mutual Funds & SIPs

- Best for long-term wealth growth.

- Equity mutual funds can beat inflation.

6. Fixed Deposits (FDs) & Senior Citizens Savings Scheme (SCSS)

- Safer, but lower returns.

- SCSS offers higher interest rates for those over 60.

👉 If you’re searching “best retirement plans in India ”, the top choices are NPS, PPF, Mutual Funds, and EPF.

Step 5 – Diversify Investments

Don’t rely on just one retirement product.

- Equity (stocks, mutual funds) → Growth & inflation-beating.

- Debt (PPF, bonds, FDs) → Stability & safety.

- Insurance & Health Plans → Protection from medical shocks.

👉 A balanced portfolio ensures steady growth + risk management.

Step 6 – Buy Adequate Health Insurance

Medical expenses can destroy savings.

- Buy health insurance early to lock lower premiums.

- Include critical illness coverage.

- For post-retirement, consider senior citizen health plans.

Step 7 – Create a Retirement Budget

As retirement approaches, prepare a budget for retirement years.

- Prioritize essential expenses.

- Cut unnecessary lifestyle expenses.

- Allocate funds for healthcare and emergencies.

Step 8 – Avoid Common Retirement Planning Mistakes

❌ Starting too late

❌ Underestimating inflation

❌ Relying only on children for support

❌ Not diversifying investments

❌ Ignoring medical insurance

Step 9 – Review and Rebalance Your Plan

Retirement planning is not “set and forget.”

- Review every 2–3 years.

- Adjust contributions based on income.

- Rebalance portfolio (reduce equity exposure near retirement).

Step 10 – Plan for Legacy and Estate

Beyond your retirement, plan how your wealth will be transferred.

- Create a Will.

- Nominate beneficiaries in all accounts.

- Consider estate planning for tax efficiency.

FAQs on Retirement Planning in India

Q1: What is the best retirement plan in India?

The National Pension System (NPS), PPF, and Mutual Funds SIPs are considered among the best for long-term retirement planning.

Q2: How much should I save for retirement in India?

Experts recommend saving at least 15–20% of your monthly income for retirement.

Q3: Is NPS better than PPF?

NPS offers higher growth due to equity exposure but carries some risk. PPF is safer with guaranteed returns. Ideally, use both.

Q4: Can I retire at 50 in India?

Yes, early retirement is possible if you build a sufficient corpus by investing aggressively in equities and reducing lifestyle expenses.

Q5: When should I start retirement planning?

The best time is in your 20s, but it’s never too late to start. The earlier you begin, the smaller the monthly contribution required.

Conclusion – Secure Your Retirement in India

Retirement planning in India is no longer optional — it’s essential. By starting early, using the right mix of EPF, PPF, NPS, mutual funds, and insurance, and avoiding common mistakes, you can ensure a financially stress-free retirement.

Remember: the goal of retirement planning is not just to survive, but to live with dignity and freedom.

👉 Start today. Your future self will thank you.